The smart Trick of Real Estate Bookkeeping Okc That Nobody is Talking About

But with a lot of accounting companies out there, how do you pick the best one? Here are 4 critical steps to take when selecting an accounting company: 1. Consider the charges charged by the accounting company. You don't want to pay too much for accounting services, however you also do not wish to choose a company that is so low-priced that they cut corners on quality.

Unknown Facts About Tax Accountant Okc

Make sure the accounting firm has experience in your market. Ask the firm about their with companies in your market and see if they have any specific understanding or accreditations that would be beneficial to you.

Ask about the firm's viewpoint on taxes. You must have a general concept of how you desire to approach taxes, and you'll want to make sure that your accounting company is on the very same page. Inquire about their thoughts on so that you can be sure they're lined up with your own views.

Take a look at the company's referrals. Just like you would with any other business choice, you'll want to make certain you're selecting a reliable and certified company. Ask the company for references from previous clients and provide a call to find out how pleased they were with the services they received.

The Ultimate Guide To Okc Tax Credits

By following these four actions, you can be positive that you're picking a certified and that will help your company succeed. Think about the fees charged by the accounting company - Vital Steps in Choosing the Right Accounting Company When you're searching for an accounting company, you desire to find one that is a great fit for your company

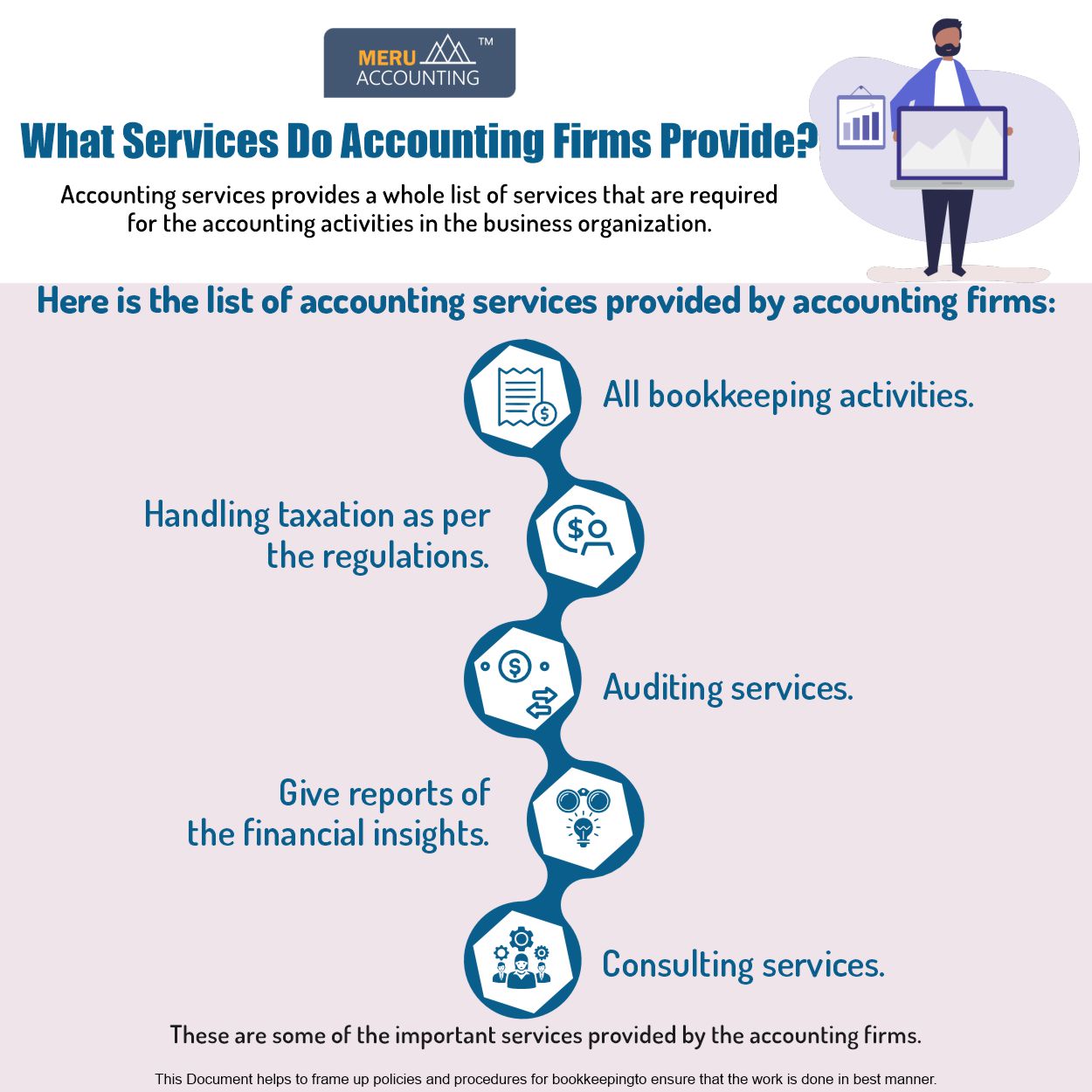

Here are some vital steps to take in picking the best accounting company: 1. Specify your needs. Before you begin satisfying with representatives from potential firms, take some time to consider what your service needs from an. What services do you need? What kind of assistance are you trying to find? What's your budget? When you have a mutual understanding of your needs, you can begin trying to find companies that focus on those locations.

The Best Strategy To Use For Okc Tax Credits

Do your research study. As soon as you have a list of possible firms, its time to do your research. Take a look at their sites and read any online reviews or reviews you can find. This will give you a common sense of their credibility and whether or notthey are a good fit for your business.

Meet agents from potential companies. When you have actually limited your list, its time to begin meeting with representatives from the companies you're considering. This is your chance to ask questions, get more information about their services, and get a feel for their personnel and company culture. Its likewise an chance for them to learn more about you and your business.

Real Estate Bookkeeping Okc - Questions

Make your choice. After you've done your research and met agents from a number of firms, its time to make your decision. Select the company that you feel most comfortable with which you think will best. Working with an accounting firm can be a great way to take your organization to the next level.

Meet agents from prospective firms - Important Steps in Picking the Right Accounting Company It's crucial to get recommendations from each prospective accounting firm. This will help you get a feel for the firm's level of experience and customer care. Make certain to ask each recommendation the same set of concerns so you can compare their actions.

Unknown Facts About Accounting Firm Okc

There's no need to lose your time with a firm that doesn't have. Picking an accounting company is a critical step in making sure the success of your company. There are numerous this decision, and it is necessary to select a company that will be a great needs. https://forums.hostsearch.com/member.php?256583-p3accounting. Here are some essential elements to consider when picking an accounting company: 1.

Make sure to choose a company that uses the services that you need, such as bookkeeping, tax preparation, and monetary planning. Select a firm that has experience working with companies in your market. This will ensure that they understand your special requirements and can provide the best possible service (CPA OKC).

Not known Details About Taxes Okc

Area The location of the accounting firm is likewise a crucial factor to consider. If you have several locations, choose a company that has offices in each of your locations. This will make it easier to contact them when you need assistance. 4. Charges When selecting an accounting firm, it is likewise important to consider their costs.

Make Get the facts your decision and select an accounting firm - Vital Steps in Picking the Right Accounting Company.